XPO LOGISTICS, INC.

Five American Lane

Greenwich, Connecticut 06831

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on May 17, 201815, 2019

To the stockholdersStockholders of XPO Logistics, Inc.:

Notice is hereby given that the annual meeting2019 Annual Meeting of stockholdersStockholders (the "Annual Meeting") of XPO Logistics, Inc. ("XPO" or the "company") will be held on Thursday,Wednesday, May 17, 201815, 2019 at 10:00 a.m. Eastern Daylight Time at Doral Arrowwood, 975 Anderson Hill Road, Rye Brook, NY 10573 for the following purposes as more fully described in the proxy statement:Company's Proxy Statement accompanying this notice (the "Proxy Statement"):

- ■

- To elect eight (8) members of our Board of Directors for a term to expire at the 2020 annual meeting of stockholders or until their successors are duly elected and qualified;

- ■

- To ratify the appointment of KPMG LLP as our independent registered public accounting firm for fiscal year 2019;

- ■

- To approve an amendment to the XPO Logistics, Inc. 2016 Omnibus Incentive Compensation Plan to increase the number of available shares thereunder by 2,000,000 to a total of 5,400,000, extend the term of the plan and make certain other changes;

- ■

- To conduct an advisory vote to approve the executive compensation of our named executive officers ("NEOs") as disclosed in the Proxy Statement;

- ■

- To consider and act upon a stockholder proposal regarding the requirement that the chairman of the Board be an independent director, if properly presented at the Annual Meeting;

- ■

- To consider and act upon a stockholder proposal regarding ways to strengthen the prevention of workplace sexual harassment and align senior executive compensation incentives, if properly presented at the Annual Meeting; and

- ■

- To consider and transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof.

Only stockholders of record of our common stock, par value $0.001 per share, and our Series A Convertible Perpetual Preferred Stock, par value $0.001 per share, as of the close of business on April 6, 201812, 2019 are entitled to receive notice of, and to vote at, the annual meetingAnnual Meeting or any adjournment or postponement of the annual meeting.Annual Meeting.

Please note that if you plan to attend the annual meetingAnnual Meeting in person, you will need to register in advance and receive an admission ticket in order to be admitted. Please follow the instructions on pages4-8 6-10 of the proxy statement.Proxy Statement.

Your vote is important. Whether or not you plan to attend the annual meetingAnnual Meeting in person, it is important that your shares be represented. We ask that you vote your shares as soon as possible.

| By Order of the Board of Directors, | ||

| ||

Bradley S. Jacobs Chairman and Chief Executive Officer | ||

Greenwich, Connecticut April 22, 2019 |

By Order of the Board of Directors,

Bradley S. Jacobs

Chairman and Chief Executive Officer

Greenwich, Connecticut

April 18, 2018

Important Notice Regarding the Availability of Proxy Materials for the

Annual Meeting of Stockholders to Be Held on May 17, 2018:15, 2019:

ThisThe Proxy Statement and our Annual Report on Form10-K for the Year Ended December 31, 2017

2018

are available atwww.edocumentview.com/XPO.

| | |

| | ©2019 |

| | |

| | | ||

|

Important Notice Regarding the Availability of Proxy Materials for the

Annual Meeting of Stockholders to Be Held on May 17, 2018 :

This Proxy Statement and our Annual Report on Form10-K for the Year Ended December 31, 2017

are available atwww.edocumentview.com/XPO.

| | |

|

This proxy statementProxy Statement sets forth information relating to the solicitation of proxies by the Board of Directors (“("Board of Directors”Directors" or “Board”"Board") of XPO Logistics, Inc. in connection with our company’s 2018 annual meeting2019 Annual Meeting of stockholders.Stockholders. This summary highlights information contained elsewhere in this proxy statement.Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statementProxy Statement carefully before voting.

2018 Annual Meeting of Stockholders

Date and Time: May 17, 2018 at 10:00 a.m. Eastern Daylight Time

2019 Annual Meeting of Stockholders |

| Date and Time | Place | Record Date | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | |

| Wednesday, May 15, 2019 at 10:00 a.m. Eastern Daylight Time | Doral Arrowwood 975 Anderson Hill Road Rye Brook, NY 10573 | You can vote if you were a stockholder of record as of the close of business on April 12, 2019 | ||||||||

| | | | | | | | | | | |

Place: Doral Arrowwood, 975 Anderson Hill Road, Rye Brook, NY 10573

Record Date: You can vote if you were a stockholder of record of our company as of the close of business on April 6, 2018 (the “Record Date”).

Admission:Admission:You will need an admission ticket to enter the annual meeting.Annual Meeting. You may request an admission ticket by providing the name under which you hold shares of record or, if your shares are held in the name of a bank, broker or other holder of record, the evidence of your beneficial ownership of shares of XPO common stock on the shares,Record Date, the number of admission tickets you are requesting and your contact information. No cameras, mobile phones or other electronic or recording devices will be allowed to be used in the meeting room.

You can submit your request by sending ane-mail tostockholdermeetings@xpo.com OR by calling us toll-free at (855)976-6951.1-855-976-6951.

This proxy statementProxy Statement and form of proxy are first being mailed on or about April 18, 2018,22, 2019, to our stockholders of record as of the close of business on April 6, 2018.12, 2019.

Voting Matters and Board Recommendations |

The Board is not aware of any matter that will be presented for a vote at the 2019 Annual Meeting of Stockholders other than those shown below.

| | | | | | | | |

| | | | 1 | | | | ©2019 XPO Logistics, Inc. |

| | | | | | | | |

| | | | | | | | |

Governance Highlights |

| | | |

| Board and Committee Independence | Seven of our eight current directors are independent. | |

The Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee consist entirely of independent directors. | ||

| | | |

| Independent Board Oversight and Leadership Roles | In 2016, our Board added a robust lead independent director position to its leadership structure to complement the roles of our independent committees and independent committee chairmen in providing effective Board oversight. In 2019, our Board added the position of an independent vice chairman to its leadership structure to provide support on key governance matters and shareholder engagement to our chairman, lead independent director and the Board. These independent structures work in conjunction with the dual roles served by our chairman and chief executive officer. The Board believes the Board and company's leadership structure functions well for our company and is in the best interests of our stockholders based on the company's current strategy and ownership structure. | |

| | | |

| Board Refreshment | Our Board is committed to creating an effective mix of useful expertise and fresh perspectives among its members, including through the thoughtful refreshment of the Board when appropriate. In 2015, the Board initiated a process to seek out highly qualified director candidates who bring relevant experience to the Board and reflect our company's growing scale and diversity. This resulted in the addition of four new directors, one in 2015, one in 2016, one in 2017 and one in 2019. | |

| | | |

| Committee Rotations | As part of its annual review of Board committee composition and committee chairmen assignments, in May 2018 and again in March 2019, the Board reconstituted its committees in order to enhance the effective functioning of the committees and bring fresh perspectives to committee processes. | |

| | | |

| Annual Director Elections | All directors are elected annually for one-year terms or until their successors are elected and qualified. | |

| | | |

| Majority Voting for Director Elections | Our bylaws provide for a majority voting standard in uncontested elections, and further require that a director who fails to receive a majority vote must tender his or her resignation to the Board. | |

| | | |

| Board Evaluations | Our Board regularly reviews committee and director performance and practices through an annual process of self-evaluation. | |

| | | |

| Risk Oversight and Financial Reporting | Our Board seeks to provide robust oversight of current and potential risks facing our company through regular deliberations and participation in management meetings. Our Audit Committee supports strong financial reporting oversight through regular meetings with management and dialogue with our auditors. | |

| | | |

| Active Participation | Our Board held 14 meetings during 2018 and each person currently serving as a director attended at least 86% of the meetings of our Board and any Board committee on which he or she served. | |

| | | |

2019 Board of Directors |

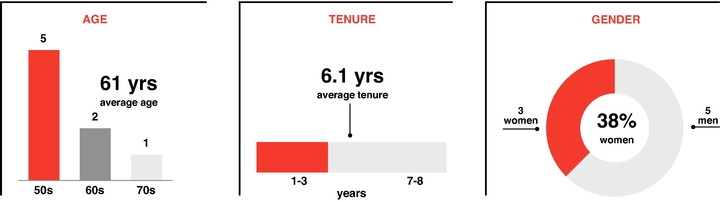

Our Board aims to create a team of directors with diverse experiences and perspectives to provide our complex, global company with thoughtful and engaged board oversight. When selecting new directors, our Board considers, among other things, the nominee's breadth of experience, financial expertise, integrity, ability to make independent analytical inquiries, understanding of our company's business environment, experience in areas relevant to our company's businesses and willingness to devote adequate time to Board duties, all in the context of the needs of the Board at that point in time and with the objective of ensuring a diversity of backgrounds, experience and viewpoints among Board members. Our Board also endeavors to actively seek out highly qualified women and individuals from underrepresented minorities to include in the pool from which Board nominees are chosen and has engaged in a purposeful process of regular refreshment as demonstrated by the following key metrics:

| | | | | | | | |

| | | | 2 | | | | ©2019 XPO Logistics, Inc. |

| | | | | | | | |

| | | | | | | | |

The following table provides summary information about each director nominee. Each director is elected annually by a majority of the votes cast.

| | | | | | Committee Memberships | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | | | | | | | |

| Name | Director Since | Age | Occupation | Independent | AC | CC | NCGC | AcqC | ||||||||

| | | | | | | | | | | | | | | | | |

Bradley S. Jacobs | 2011 | 62 | Chairman and Chief Executive Officer, XPO Logistics, Inc. | | | | | | ||||||||

Gena L. Ashe | 2016 | 57 | President and Chief Executive Officer, GLA Legal Advisory Group, LLC | Y | ✓ | ✓ | ||||||||||

Marlene M. Colucci | 2019 | 56 | Executive Director of The Business Council | Y | | ✓ | | ✓ | ||||||||

AnnaMaria DeSalva | 2017 | 50 | Vice Chairman, XPO Logistics, Inc. | Y | C | |||||||||||

Michael G. Jesselson | 2011 | 67 | Lead Independent Director, XPO Logistics, Inc. President and Chief Executive Officer, Jesselson Capital Corporation | Y | ✓ | ✓ | ✓ | | ||||||||

Adrian P. Kingshott | 2011 | 59 | Chief Executive Officer, AdSon, LLC | Y | C | ✓ | ||||||||||

Jason D. Papastavrou* | 2011 | 56 | Founder and Chief Investment Officer, ARIS Capital Management, LLC | Y | ✓ | ✓ | ✓ | C | ||||||||

Oren G. Shaffer* | 2011 | 76 | Former Vice Chairman and Chief Financial Officer, Qwest Communications International, Inc. | Y | C | |||||||||||

| | | | | | | | | | | | | | | | | |

AC = Audit Committee CC = Compensation Committee | NCGC = Nominating and Corporate Governance Committee AcqC = Acquisition Committee | C = Committee Chairman ✓ = Committee Member * = Audit Committee Financial Expert |

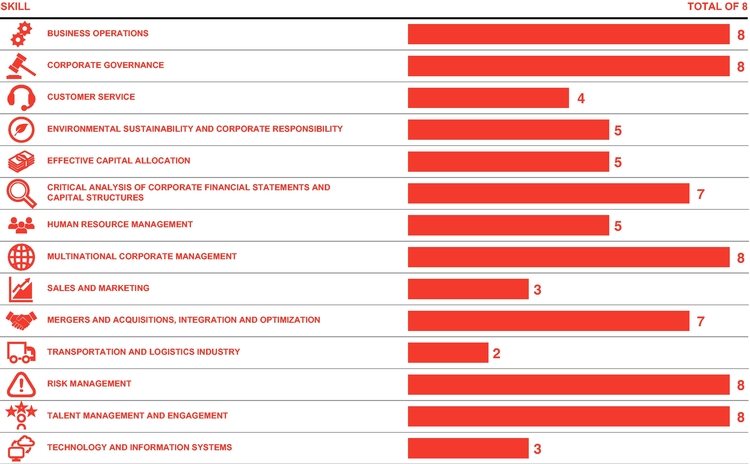

The following table provides a summary of the qualifications and experience of our director nominees.

| | | | | | | | |

| | | | 3 | | | | ©2019 XPO Logistics, Inc. |

| | | | | | | | |

| | | | | | | | |

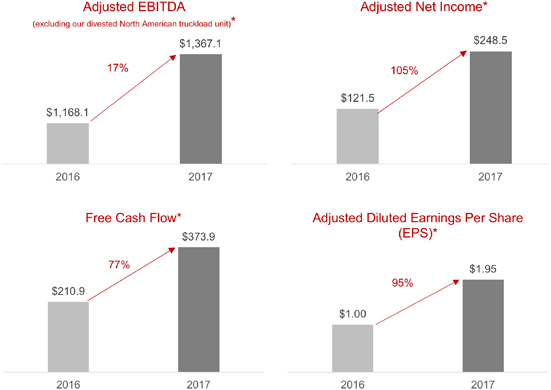

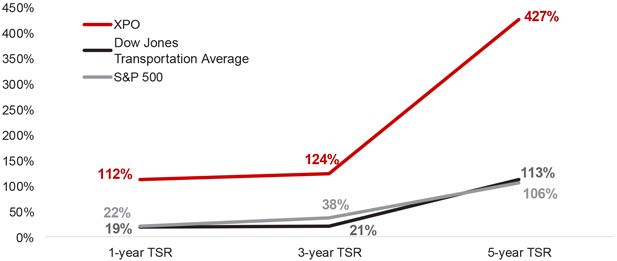

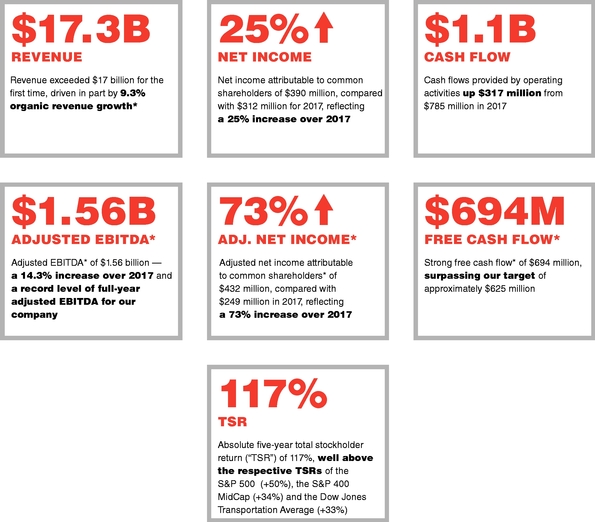

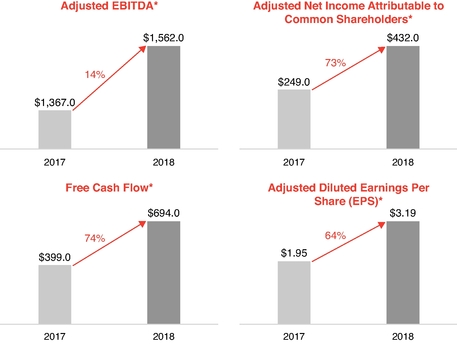

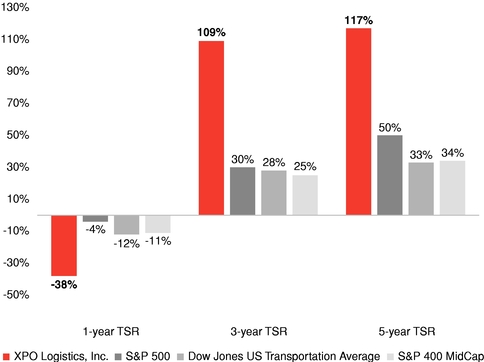

2018 Performance Highlights |

In 2018, XPO delivered a year of record results. Under the leadership of our NEOs, in 2018 we reported:

- *

- See Annex A for a reconciliation of this Non-GAAP measure.

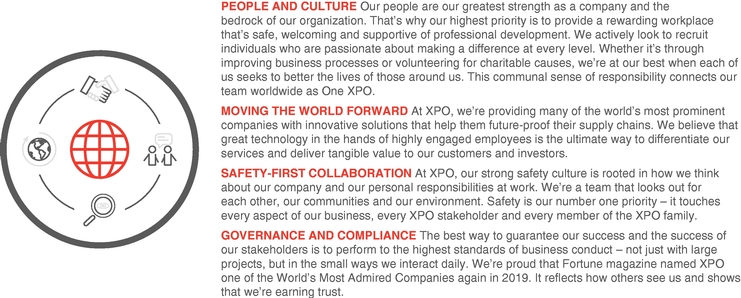

Sustainability Efforts |

We are pleased to have published our 2018 Sustainability Report highlighting our initiatives in the following areas:

| | | | | | | | |

| | | | 4 | | | | ©2019 XPO Logistics, Inc. |

| | | | | | | | |

| | | | | | | | |

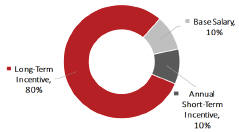

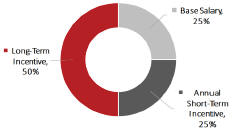

2018 Compensation Highlights |

Our compensation program for NEOs is focused on our dedication to a pay-for-performance culture and our commitment to align executive compensation with long-term stockholder value.

Dedication to |

In recognition of the fact that XPO did not meet its adjusted EBITDA goal in 2018, and in their unwavering dedication to leading our company's pay-for-performance culture by example, our Compensation Committee, together with our NEOs, took the following actions:

| | | | | | | |

In 2018,

valued at $4 million in total. | ||||||

| | | | | | | |

| No NEOs received full target bonus payouts for 2018. | |||||

| | | | | | | |

Four of our | ||||||

| | | | | | | |

Mr. Jacobs and Mr. Cooper voluntarily declined their full 2018 cash bonuses. | ||||||

| | | | | | | |

Commitment to |

All outstanding equity awards for Mr. Jacobs, Mr. Cooper and Mr. Harik are performance-based. In addition, for each of Mr. Jacobs, Mr. Cooper and Mr. Harik, we:

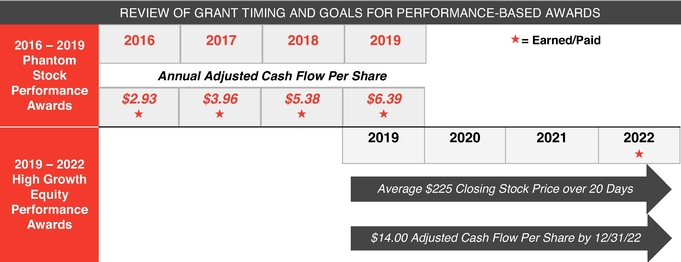

Key Features of the 2019 – 2022 PRSUs |

| | | | | | | |

Award cannot be earned until after the four-year performance period ending December 31, 2022 | ||||||

| | | | | | | |

No overlapping payment periods with other outstanding awards - the final tranche of the 2016 cash-settled PRSU grant to each of Mr. Jacobs, Mr. Cooper and Mr. Harik is scheduled to pay out in the first quarter of 2020, if performance is achieved | ||||||

| | | | | | | |

Requires achievement of both of the following high-growth stretch goals: |

Average stock price of $225 over a 20-trading day period | Average stock price represents an approximate 41% increase in share price per year over the four-year period compared to XPO's closing stock price on December 31, 2018 | |||||

Adjusted cash flow per share of $14.00 by December 31, 2022 |

| Adjusted cash flow per share performance criteria requires: – A 20% compounded annual growth rate in Adjusted EBITDA over the four-year period – More than 120% growth in adjusted cash flow per share versus 2018 | ||||

| | | | | | | |

| | | | | | | | |

| | | | 5 | | | | ©2019 XPO Logistics, Inc. |

| | | | | | | | |

| | | | | | | | |

This Proxy Statement sets forth information relating to the solicitation of proxies by the Board of Directors (our "Board of Directors" or our "Board") of XPO Logistics, Inc. ("XPO" or our "company") in connection with our 2019 Annual Meeting of Stockholders (the "Annual Meeting") or any adjournment or postponement thereof. This Proxy Statement (the "Proxy Statement") is being furnished by our Board of Directors for use at the Annual Meeting to be held on May 15, 2019 at 10:00 a.m. Eastern Daylight Time at Doral Arrowwood, 975 Anderson Hill Road, Rye Brook, NY 10573.

This Proxy Statement and form of proxy are first being mailed on or about April 22, 2019, to our stockholders of record as of the close of business on April 12, 2019 (the "Record Date").

The following answers address some questions you may have regarding our Annual Meeting. These questions and answers may not include all of the information that may be important to you as a stockholder of our company. Please refer to the more detailed information contained elsewhere in this proxy statement.

What items of business will be voted on at the

|

We expect that the business put forth for a vote at the Annual Meeting will be as follows:

In addition,

- ■

- To elect eight (8) members of our Board of Directors for a term to expire at the 2020 annual meeting of stockholders or until their successors are duly elected and qualified (Proposal 1);

- ■

- To ratify the appointment of KPMG LLP ("KPMG") as our independent registered public accounting firm for fiscal year 2019 (Proposal 2);

- ■

- To approve an amendment to the XPO Logistics, Inc. 2016 Omnibus Incentive Compensation Plan to increase the number of available shares thereunder by 2,000,000 to a total of 5,400,000, extend the term of the plan and make certain other changes (Proposal 3);

- ■

- To conduct an advisory vote to approve the executive compensation of our named executive officers ("NEOs") as disclosed in this Proxy Statement (Proposal 4);

- ■

- To consider and act upon a stockholder proposal regarding the requirement that the chairman of the Board be an independent director, if properly presented at the Annual Meeting (Proposal 5);

- ■

- To consider and act upon a stockholder proposal regarding ways to strengthen the prevention of workplace sexual harassment and align senior executive compensation incentives, if properly presented at the Annual Meeting (Proposal 6); and

- ■

- To consider and transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof.

Senior management of XPO and representatives of our outside auditor, KPMG, will be available to respond to appropriate questions.

Who can attend and vote at the |

You are entitled to receive notice of and to attend and vote at the Annual Meeting, or any adjournment or postponement thereof, if, as of the close of business on April 12, 2019, the Record Date, you were a holder of record of our common stock or Series A Convertible Perpetual Preferred Stock (the "Series A Preferred Stock").

As of the Record Date, there were 92,233,726 shares of common stock issued and outstanding, each of which is entitled to one vote on each matter to come before the annual meeting. In addition, as of the Record Date, there were 71,110 shares of Series A Preferred Stock issued and outstanding. Each share of Series A Preferred Stock is entitled to vote together with our common stock on each matter to come before the Annual Meeting as if the shares of Series A Preferred Stock were converted into shares of common stock as of the Record Date, meaning that each share of Series A Preferred Stock is entitled to approximately 143 votes on each matter to come before the Annual Meeting. As a result, a total of 102,392,297 votes are eligible to be cast at the Annual Meeting based on the number of outstanding shares of our common stock and Series A Preferred Stock, voting together as a single class.

If you wish to attend the Annual Meeting, you will need to obtain and bring an admission ticket as outlined below. If the shares of common stock you hold are entitled to receive notice of and to attend and vote at the annual meeting, or any adjournment or postponement thereof, if, as of the close of business on April 6, 2018, the Record Date, you were a holder of record of our common stock or Series A Convertible Perpetual Preferred Stock (the “Series A Preferred Stock”).

As of the Record Date, there were 120,597,574 shares of common stock issued and outstanding, each of which is entitled to one vote on each matter to come before the annual meeting. In addition, as of the Record Date, there were 71,510 shares of Series A Preferred Stock issued and outstanding. Each share of Series A Preferred Stock is entitled to vote together with our common stock on each matter to come before the annual meeting as if the shares of Series A Preferred Stock were converted into shares of common stock as of the Record Date, meaning that each share of Series A Preferred Stock is entitled to approximately 143 votes on each matter to come before the annual meeting. As a result, a total of 130,813,288 votes are eligible to be cast at the annual meeting based on the number of outstanding shares of our common stock and Series A Preferred Stock, voting together as a single class.

If you wish to attend the annual meeting and your shares are held in an account at a broker, dealer, commercial bank, trust company or other nominee (i.e., in

| | | | | | | | | |||||||||||||||||||||||||||||||||||||||||||||

| | | | 6 | | | | ©2019 XPO Logistics, | |||||||||||||||||||||||||||||||||||||||||||||

"street name"), and you wish to vote at the Annual Meeting will need to obtain a proxy from the broker, dealer, commercial bank, trust company or other nominee that holds your shares. Do I need a ticket to attend the

|

Yes, you will need an admission ticket to enter the Annual Meeting. You may request tickets by providing the name under which you hold shares of record or, if your shares are held in the name of a bank, broker or other holder of record, the evidence of your beneficial ownership of the shares of XPO common stock as of the Record Date, the number of tickets you are requesting and your contact information. You can submit your request in the following ways:

Stockholders also must present a form of personal photo identification in order to be admitted to the annual meeting.

- ■

- By sending an e-mail tostockholdermeetings@xpo.com; or

- ■

- By calling us toll-free at 1-855-976-6951.

Stockholders also must present a form of personal photo identification in order to be admitted to the Annual Meeting. No cameras, mobile phones or other electronic or recording devices will be allowed to be used in the meeting room.

How many shares of XPO common stock or Series A Preferred Stock must be present to conduct business at the

|

A quorum is necessary to hold a valid meeting of stockholders. For each of the proposals to be presented at the Annual Meeting, the holders of shares of our common stock or Series A Preferred Stock outstanding on the Record Date representing 51,196,150 votes must be present at the Annual Meeting, in person or by proxy. If you vote by internet, telephone or proxy card, the shares you vote will be counted towards the quorum for the Annual Meeting. Abstentions and broker non-votes are counted as present for the purpose of determining a quorum.

What are my voting choices?

|

With respect to the election of directors, you may vote"FOR" or"AGAINST" each of the director nominees, or you may"ABSTAIN" from voting for one or more of such nominees. With respect to the other proposals to be considered at the Annual Meeting, you may vote"FOR" or"AGAINST" or you may"ABSTAIN" from voting on any proposal. If you sign your proxy without giving specific instructions, your shares will be voted in accordance with the recommendations of our Board of Directors with respect to the specific proposals described in this Proxy Statement and at the discretion of the proxy holders on any other matters that properly come before the Annual Meeting.

What vote is required to approve the proposals being considered at the

Table of Contents

Series A Preferred Stock had converted into shares of our common stock as of the Record Date) at the Annual Meeting at which a quorum is present.

In general, other business properly brought before the Annual Meeting requires the affirmative vote of a majority of the votes cast (meaning the number of shares voted "for" such proposal must exceed the number of shares voted "against" such proposal) by holders of shares of our common stock (including those that would be issued if all our outstanding Series A Preferred Stock had converted into shares of our common stock as of the Record Date) at the Annual Meeting at which a quorum is present.

Our Board of Directors, after careful consideration, recommends that our stockholders vote"FOR" the election of each director nominee named in this proxy statement,"FOR" ratification of KPMG as our independent registered public accounting firm for fiscal year 2019,"FOR" approval of an amendment to the company's incentive compensation plan,"FOR" advisory

approval of the resolution to approve executive compensation,"AGAINST" the approval of the stockholder proposal regarding the requirement that the chairman of the board be an independent director, if such proposal is properly presented at the meeting, and"AGAINST" the approval of the stockholder proposal regarding ways to strengthen the prevention of workplace sexual harassment and align senior executive compensation incentives, if such proposal is properly presented at the meeting.

We urge you to read this Proxy Statement carefully, then mail your completed, dated and signed proxy card in the enclosed return envelope as soon as possible so that your shares of our common stock can be voted at the Annual Meeting of stockholders. Holders of record may also vote by telephone or the internet by following the instructions on the proxy card.

Registered Stockholders. If you are a registered stockholder (i.e., you hold your shares in your own name through our transfer agent, Computershare Trust Company, N.A., and not through a broker, bank or other nominee that holds shares for your account in "street name"), you may vote by proxy via the internet, by telephone, or by mail by following the instructions provided on the proxy card. Proxies submitted via telephone or internet must be received by 1:00 a.m. Eastern Daylight Time on May 15, 2019. Please see the proxy card provided to you for instructions on how to submit your proxy by telephone or the internet. Stockholders of record who attend the Annual Meeting may vote in person by obtaining a ballot from the inspector of elections. Beneficial Owners. If you are a beneficial owner of shares (i.e., your shares are held in the name of a brokerage firm, bank or a trustee), you may vote by proxy by following the instructions provided in the voting instruction form or other materials provided to you by the brokerage firm, bank or other nominee that holds your shares. To vote in person at the Annual Meeting, you must obtain a legal proxy from the brokerage firm, bank or other nominee that holds your shares.

If you hold shares as the stockholder of record, your vote by proxy must be received before the polls close at the Annual Meeting. As indicated on the proxy card provided to you, proxies submitted via telephone or internet must be received by 1:00 a.m. Eastern Daylight Time on May 15, 2019. If you are the beneficial owner of shares of our common stock, please follow the voting instructions provided by your broker, trustee or other nominee.

You should instruct your broker or other nominee on how to vote your shares of our common stock using the instructions provided by such broker or other nominee. Absent specific voting instructions, brokers or other nominees who hold shares of our common stock in "street name" for customers are prevented by the rules set forth in the Listed Company Manual (the "NYSE Rules") of the New York Stock Exchange (the "NYSE") from exercising voting discretion with respect to non-routine or contested matters. We expect that when the NYSE evaluates the proposals to be voted on at the Annual Meeting to determine whether each proposal is a routine or non-routine matter, only "Proposal 2–Ratification of the Appointment of KPMG LLP as Our Independent Registered Public Accounting Firm for Fiscal Year 2019" will be determined to be routine. Shares not voted

by a broker or other nominee, because such broker or other nominee does not have instructions or cannot exercise discretionary voting power with respect to one or more proposals, are referred to as "broker non-votes." It is important that you instruct your broker or other nominee on how to vote your shares of our common stock held in "street name" in accordance with the voting instructions provided by such broker or other nominee.

Yes. Whether you attend the Annual Meeting or not, you may revoke a proxy at any time before your proxy is voted at the Annual Meeting. You may do so by properly delivering a later-dated proxy either by mail, the internet or telephone or by attending the Annual Meeting in person and voting. Please note, however, your attendance at the Annual Meeting will not automatically revoke any prior proxy, unless you vote again at the Annual Meeting or specifically request in writing that your prior proxy be revoked. You also may revoke your proxy by delivering a notice of revocation to our company (Attention: Secretary, XPO Logistics, Inc., Five American Lane, Greenwich, Connecticut 06831) prior to the vote at the Annual Meeting. If you hold your shares through a broker, dealer, commercial bank, trust company or other nominee, you should follow the instructions of such broker or other nominee regarding revocation of proxies.

If you are a registered stockholder (i.e., you hold your shares of our common stock in your own name through our transfer agent, Computershare Trust Company, N.A., and not through a broker, bank or other nominee that holds shares for your account in "street name") and you complete and submit a proxy, the persons named as proxies will follow your instructions. If you submit a proxy but do not provide instructions, or if your instructions are unclear, the persons named as proxies will vote as recommended by our Board of Directors or, if no recommendation is given, by using their own discretion.

The company will pay for the cost of soliciting proxies. We have engaged Innisfree M&A Incorporated to assist us in soliciting proxies in connection with the Annual Meeting and have agreed to pay them approximately $12,500 plus their expenses for providing such services. Our directors, officers and other employees, without additional compensation, may solicit proxies personally, in writing, by telephone, by

In accordance with notices to many stockholders who hold their shares through a bank, broker or other holder of record (a "street-name stockholder") and share a single address, only one copy of our Proxy Statement and 2018 Annual Report to stockholders is being delivered to that address unless contrary instructions from any stockholder at that address are received. This practice, known as "householding," is intended to reduce our printing and postage costs. However, any such street-name stockholders residing at the same address who wish to receive a separate copy of this Proxy Statement and the 2018 Annual Report may request a copy by contacting their bank, broker or other holder of record, or by sending a written request to: Investor Relations, XPO Logistics, Inc., Five American Lane, Greenwich, Connecticut 06831, or by contacting Investor Relations by telephone at 1-855-976-6951. The voting instruction form sent to a street-name stockholder should provide information on how to request: (1) householding of future company materials, or (2) separate materials if only one set of documents is being sent to a household.

Our mission is to be the leading provider of cutting-edge supply chain solutions to the most successful companies in the world, and to do this by using our highly integrated network of people, technology and physical assets to help our customers manage their goods most efficiently throughout their supply chains. We run our business on a global basis, with over 50,000 customers served by more than 100,000 employees and 1,535 locations in 32 countries, including the United States, France, the United Kingdom and Spain. Our transportation segment offers customers an unmatched network of multiple modes, flexible capacity and route density that transports freight quickly and cost effectively from origin to destination. Through our logistics segment, we provide a range of differentiated and data-intensive services, including highly engineered and customized solutions, value-added warehousing and distribution, omnichannel fulfillment, cold chain distribution, reverse logistics, surge management and other inventory management solutions. Our blueprint for transforming transportation and logistics is rooted in innovation and revolves around our people. We care deeply about keeping our employees and customers happy, and we view safety, sustainability, strong governance and a purpose-driven culture as essential components of value creation. In addition, our company is a leading proponent of technology, with a global team of technologists and data scientists who concentrate their efforts in four areas of innovation: (1) automation and intelligent machines, (2) visibility and customer service, (3) the digital freight marketplace and (4) dynamic data science. Our success depends on our people. Our Board of Directors consists of a highly skilled group of leaders who share our values and reflect our culture. Many of our directors have served as executive officers or served on boards of major companies and have an extensive understanding of the principles of corporate governance. In addition, our directors have a strong owner orientation—approximately 18.3% of the voting power of our capital stock on a fully-diluted basis is held by our directors or by entities or persons related to our directors (as of the Record Date). As described on page 17, our Board as a whole has broad expertise with the following skill sets that are relevant to our company, business, industry and strategy:

|

Our Board of Directors currently consists of eight (8) members, as set forth in the table below. The current term of each of our directors will expire at the Annual Meeting. Our Board has nominated all of the current directors to stand for election at the Annual Meeting, as set forth in Proposal 1 on page 59 of this Proxy Statement.

| Name | Occupation | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bradley S. Jacobs | Chairman and Chief Executive Officer, XPO Logistics, Inc. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gena L. Ashe | President and Chief Executive Officer, GLA Legal Advisory Group, LLC | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Marlene M. Colucci | Executive Director, The

|

Under the terms of an Investment Agreement, dated June 13, 2011 (the "Investment Agreement"), by and among Jacobs Private Equity, LLC ("JPE"), the other investors party thereto (collectively with JPE, the "Investors"), and our company, JPE has the right to designate certain percentages of the nominees for our Board of Directors so long as JPE owns securities (including preferred stock convertible into, or warrants exercisable for, securities) representing specified percentages of the total voting power of our capital stock on a fully-diluted basis. JPE does not currently own securities representing the required voting power to qualify for the right to designate nominees for our Board of Directors. The foregoing rights of JPE under the Investment Agreement are in addition to, and not in limitation of, JPE's voting rights as a holder of capital stock of our company. JPE is controlled by Bradley S. Jacobs, our chairman and chief executive officer. The Investment Agreement and the terms contemplated therein were approved by our stockholders at a special meeting on September 1, 2011.

None of the foregoing will prevent our Board of Directors from acting in accordance with its fiduciary duties or applicable law or stock exchange requirements or from acting in good faith in accordance with our governing documents, while giving due consideration to the intent of the Investment Agreement.

Set forth below is information regarding each of our director nominees, including the experience, qualifications, attributes or skills that led our Board of Directors to conclude that such person should serve as a director.

| Bradley S. Jacobs | Chairman and Director since 2011 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Age: 62 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Mr. Jacobs has served as our chief executive officer and chairman of our Board of Directors | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Board Committees: None

Mr. Jacobs brings to the Board: | ■ In-depth knowledge of the company's business resulting from his years of service with the company as its chief executive officer; ■ Leadership experience as the company's chairman and chief executive officer, and a successful track record of leading companies that execute strategies similar to ours; and ■ Extensive past experience as the chairman of the board of directors of several public companies. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| | | | | | | | |

| | | | 12 | | | | ©2019 XPO Logistics, Inc. |

| | | | | | | | |

| | | | | | | | |

| Gena L. Ashe | Director since 2016 | |||||||||||

Age: 57 | ||||||||||||

Ms. Ashe has served as a director of the company since March 21, 2016. Ms. Ashe has served as the president and chief executive officer of GLA Legal Advisory Group, LLC since February 2018. Also, Ms. Ashe has served as vice-chairman of the Supervisory Board of XPO Logistics Europe S.A., our majority-owned subsidiary, since February 2017. She was senior vice president, chief legal officer and corporate secretary of Adtalem Global Education Inc. (NYSE: ATGE) from May 2017 to February 2018, and executive vice president, chief legal officer, and corporate secretary of BrightView Landscapes, LLC (formerly The Brickman Group, Ltd. LLC) from December 2012 to June 2016. Earlier, she served as senior vice president of legal affairs for Catalina Marketing Corporation and held senior legal roles with the Public Broadcasting Service ("PBS"), Darden Restaurants, Inc., Lucent Technologies and AT&T. Earlier in her career, Ms. Ashe served as an electrical engineer and scientist for IBM Corporation before joining IBM's legal team. Ms. Ashe holds a juris doctorate degree from Georgetown University Law Center, where she serves on the Georgetown Law Advisory Board, a master's degree in electrical engineering from Georgia Institute of Technology and a bachelor's degree in mathematics from Spelman College, where she sits on the Board of Trustees. She has completed the executive development program at the Wharton School of the University of Pennsylvania and holds a certificate in international management from Oxford University in England. | ||||||||||||

■

Member of Audit Committee ■ Member of Acquisition Committee

|

| |||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

Other Public Company Boards: None | ||||||||

|

| |||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

|

| |||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

■

■

An in-depth understanding of the dynamics of three of our most important customer verticals: e-commerce, technology and food and beverage.

| Marlene M. Colucci | Director since 2019 | |||||

Age: 56 | ||||||

Ms. Colucci has served as a director of the company since February 7, 2019. She has served as the executive director of The Business Council in Washington, D.C. since July 2013. Previously, she was executive vice president of public policy for the American Hotel & Lodging Association from September 2005 to June 2013, where she provided guidance on regulatory matters. From September 2003 to June 2005, she served in the White House as special assistant to President George W. Bush in the Office of Domestic Policy. In this role, she developed labor, transportation and postal reform policies and advised the president and his staff on related matters. Earlier, Ms. Colucci served as deputy assistant secretary with the U.S. Department of Labor's Office of Congressional and Intergovernmental Affairs. Her law career includes more than 12 years with the firm of Akin Gump Strauss Hauer & Feld LLP, where she served as senior counsel. She holds a juris doctorate degree from the Georgetown University Law Center. | ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

■

■

Member of Acquisition Committee

Other Public Company Boards: None

■

Significant experience with public policy development, including labor and transportation policy, from over two decades of relevant government and private sector experience; and

■

Meaningful perspectives on matters of corporate governance and business operations from her tenure leading the premier association of chief executive officers of the world's most important business enterprises.

| | | | | | | | |

| | | | 13 | | | | ©2019 XPO Logistics, Inc. |

| | | | | | | | |

| | | | | | | | |

| AnnaMaria DeSalva | Director since 2017 | |

Age: 50 | Vice Chairman since 2019 | |

Ms. DeSalva has served as a director of the company since September 19, 2017, and vice chairman of the Board since February 7, 2019. She is a senior corporate affairs advisor to leading companies. Ms. DeSalva served as chief communications officer of E.I. du Pont de Nemours & Co. (DuPont) from March 2014 to January 31, 2018 and currently serves as senior advisor to the CEO of DowDuPont. Previously, she served as vice president of corporate affairs for biopharmaceutical innovation at Pfizer; was an advisor to the U.S. Food and Drug Administration; and led the global healthcare practice of Hill & Knowlton. For Bristol-Myers Squibb, she led global public affairs for the oncology business and served as the director of the Bristol-Myers Squibb Foundation. Ms. DeSalva serves on the board of governors of Argonne National Laboratory of the U.S. Department of Energy and is a member of its compensation and nominating committees; as well as the boards of directors of the non-profit Project Sunshine and the William & Mary Alumni Association. She is a graduate of The College of William & Mary in Williamsburg, Virginia; and has completed the Harvard School of Public Health's executive education program in risk communication, and the Advanced Health Leadership Program jointly offered by the University of California at Berkeley and Pompeu University in Barcelona, Spain. | ||

| Board Committees: ■ Chairman of Nominating and Corporate Governance Committee | ||

Other Public Company Boards: None | ||

| Ms. DeSalva brings to the Board: ■ Significant experience in corporate affairs, regulatory affairs and corporate social responsibility, having previously served in senior leadership roles at several public companies; and ■ Expertise in managing significant public company merger transactions, with an emphasis on effective change management and external stakeholder engagement. | ||

| Michael G. Jesselson | Director since 2011 | |

Age: 67 | Lead Independent Director since 2016 | |

Mr. Jesselson has served as director of the company since September 2, 2011, and as lead independent director since March 20, 2016. He has been president and chief executive officer of Jesselson Capital Corporation since 1994. Mr. Jesselson served as a director of American Eagle Outfitters, Inc. (NYSE: AEO) from November 1997 to May 2017, most recently as its lead independent director. Prior to that, he worked at Philipp Brothers, a division of Engelhard Industries from 1972 to 1981, then at Salomon Brothers Inc. in the financial trading sector. He is a director of C-III Capital Partners LLC, Clarity Capital and other private companies, as well as numerous philanthropic organizations. Mr. Jesselson also serves as the chairman of Bar Ilan University in Israel. He attended New York University School of Engineering. | ||

| Board Committees: ■ Member of Audit Committee ■ Member of Compensation Committee ■ Member of Nominating and Corporate Governance Committee | ||

Other Public Company Boards: None | ||

| Mr. Jesselson brings to the Board: ■ Significant experience with public company corporate governance issues through prior service on the board of directors of American Eagle Outfitters, including as its lead independent director; and ■ Extensive investment expertise. | ||

| | | | | | | | |

| | | | 14 | | | | ©2019 XPO Logistics, Inc. |

| | | | | | | | |

| | | | | | | | |

| Adrian P. Kingshott | Director since 2011 | |

Age: 59 | ||

Mr. Kingshott has served as a director of the company since September 2, 2011. He has served as the chief executive officer of AdSon, LLC since October 2005, managing director of Spotlight Advisors, LLC since September 2015 and a member of the board of directors of Centre Lane Investment Corp. since May 2011. Mr. Kingshott was a senior advisor to Headwaters Merchant Bank from 2013 until June 2018. Previously, with Goldman Sachs, he was co-head of the firm's Global Leveraged Finance business and held other positions over a 17-year tenure. More recently, Mr. Kingshott was a managing director and portfolio manager at Amaranth Advisors, LLC. He is an adjunct professor of Global Capital Markets and Investments at Fordham University's Gabelli School of Business. He holds a master's degree in business administration from Harvard Business School and a master of jurisprudence degree from Oxford University. | ||

| Board Committees: ■ Chairman of Compensation Committee ■ Member of Acquisition Committee | ||

Other Public Company Boards: None | ||

| Mr. Kingshott brings to the Board: ■ More than 25 years of experience in the investment banking and investment management industries; and ■ Expertise with respect to corporate governance, acquisition transactions, debt and equity financing and corporate financial management issues. | ||

| Jason D. Papastavrou, Ph.D. | Director since 2011 | |

Age: 56 | ||

Dr. Papastavrou has served as a director of the company since September 2, 2011. He founded ARIS Capital Management, LLC in 2004 and serves as its chief investment officer. Previously, Dr. Papastavrou was the founder and managing director of the Fund of Hedge Funds Strategies Group of Banc of America Capital Management (BACAP), president of BACAP Alternative Advisors, and a senior portfolio manager with Deutsche Asset Management. He was a tenured professor at Purdue University School of Industrial Engineering and holds a doctorate in electrical engineering and computer science from the Massachusetts Institute of Technology. Dr. Papastavrou serves on the board of directors of United Rentals, Inc. (NYSE: URI). | ||

| Board Committees: ■ Chairman of Acquisition Committee ■ Member of Audit Committee ■ Member of Compensation Committee ■ Member of Nominating and Corporate Governance Committee | ||

Other Public Company Boards: United Rentals, Inc. (since 2005) | ||

| Dr. Papastavrou brings to the Board: ■ Financial expertise related to his qualifications as an "audit committee financial expert" under SEC regulations; and ■ Extensive experience with finance and risk-related matters, from holding senior positions at investment management firms. | ||

| | | | | | | | |

| | | | 15 | | | | ©2019 XPO Logistics, Inc. |

| | | | | | | | |

| | | | | | | | |

| Oren G. Shaffer | Director since 2011 | |

Age: 76 | ||

Mr. Shaffer has served as a director of the company since September 2, 2011. From 2002 to 2007, Mr. Shaffer was vice chairman and chief financial officer of Qwest Communications International, Inc. (now CenturyLink, Inc.). Previously, Mr. Shaffer was president and chief operating officer of Sorrento Networks, Inc., executive vice president and chief financial officer of Ameritech Corporation, and held senior executive positions with The Goodyear Tire & Rubber Company, where he also served on the board of directors. Additionally, Mr. Shaffer is a director on the board of Terex Corporation (NYSE: TEX). He holds a master's degree in management from the Sloan School of Management, Massachusetts Institute of Technology, and a degree in finance and business administration from the University of California, Berkeley. | ||

| Board Committees: ■ Chairman of Audit Committee | ||

Other Public Company Boards: Terex Corporation (since 2007) | ||

| Mr. Shaffer brings to the Board: ■ Senior financial, operational and strategic experience with various large companies; ■ Corporate governance expertise from serving as director of various public companies; and ■ Financial expertise related to his qualifications as an "audit committee financial expert" under SEC regulations. | ||

| | | | | | | | |

| | | | 16 | | | | ©2019 XPO Logistics, Inc. |

| | | | | | | | |

| | | | | | | | |

Summary of Qualifications and Experience of Director Nominees |

| | | | | | | | | | | | | | | | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Bradley S. Jacobs | | | Gena L. Ashe | | | Marlene M. Colucci | | | AnnaMaria DeSalva | | | Michael G. Jesselson | | | Adrian P. Kingshott | | | Jason D. Papastavrou, Ph.D. | | | Oren G. Shaffer | ||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

BUSINESS OPERATIONSexperience provides a practical understanding of developing, implementing and assessing our operating plan and business strategy. | | | | | | | | | | | | | | | | |||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

CORPORATE GOVERNANCEexperience bolsters Board and management accountability, transparency and a focus on stockholder interests. | | | | | | | | | | | | | | | | |||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

CUSTOMER SERVICEexperience brings an important perspective to our Board given the importance of customer service to our business model. | | | | | | | | | | | | | | | | | | |||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

ENVIRONMENTAL SUSTAINABILITY AND CORPORATE RESPONSIBILITYexperience allows our Board's oversight to guide our long-term value creation for stockholders in a way that is responsible and sustainable. | | | | | | | | | | | | | | | | | ||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

EFFECTIVE CAPITAL ALLOCATIONexperience is crucial to our Board's evaluation of our financial statements and capital structure. | | | | | | | | | | | | | | | | | ||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

CRITICAL ANALYSIS OF CORPORATE FINANCIAL STATEMENTS AND CAPITAL STRUCTURESassists our directors in understanding and overseeing our financial reporting and internal controls. | | | | | | | | | | | | | | | | | ||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

HUMAN RESOURCE MANAGEMENTexperience allows our Board to further our company's goals in making XPO an inclusive and attractive employment environment and aligning human resources objectives with our strategic and operational priorities. | | | | | | | | | | | | | | | | | ||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

MULTINATIONAL CORPORATE MANAGEMENTexperience is important, given the global nature of our business strategy and operations. | | | | | | | | | | | | | | | | |||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

SALES AND MARKETINGexperience helps our Board assist with our business strategy and with developing new products and operations. | | | | | | | | | | | | | | | | | | | ||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

MERGERS AND ACQUISITIONS, INTEGRATION AND OPTIMIZATIONexperience helps our company identify the optimal targets for M&A activity to achieve our strategic objectives and realize synergies and growth. | | | | | | | | | | | | | | | | | ||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

TRANSPORTATION AND LOGISTICS INDUSTRYexperience is important in understanding and reviewing our business and strategy. | | | | | | | | | | | | | | | | | | |||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

RISK MANAGEMENTexperience is critical to our Board's role in overseeing the risks facing our company. | | | | | | | | | | | | | | | | |||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

TALENT MANAGEMENT AND ENGAGEMENTexperience helps XPO attract, motivate and retain top candidates for leadership roles. | | | | | | | | | | | | | | | | |||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

TECHNOLOGY AND INFORMATION SYSTEMSexperience is relevant as we continually seek to enhance our customer experience and internal operations. | | | | | | | | | | | | | | | | | | | ||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | 17 | | | | ©2019 XPO Logistics, Inc. |

| | | | | | | | |

| | | | | | | | |

|

|

|

|

|

|

| ||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

|

Role of the Board and Board Leadership Structure

Our business and affairs are managed under the direction of our Board of Directors, which is our company’s ultimate decision-making body, except with respect to those matters reserved to our stockholders. Our Board’s primary responsibility is to seek to maximize long-term stockholder value. Our Board establishes our overall corporate policies, selects and evaluates our senior management team, which is charged with the conduct of our business, monitors the performance of our company and management, and provides advice and counsel to management. In fulfilling the Board’s responsibilities, our directors have full access to our management, internal and external auditors and outside advisors.

Furthermore, our Board of Directors is committed to independent Board oversight. Our current Board leadership structure includes an executive Chairman as well as a lead independent director. The positions of Chairman of the Board and Chief Executive Officer are both currently held by Mr. Jacobs. Our Board believes that this combination of roles is appropriate because the structure enables decisive leadership and ensures clear accountability in the context of strong Board practices and a Board culture that facilitates independent oversight. Our Board believes the dual roles function well for our company based on our current strategy, governance and ownership structure.

In addition, our Board of Directors has approved a set of Corporate Governance Guidelines (the “Guidelines”), which provide that the independent directors may appoint a lead independent director who presides over executive sessions of the independent directors, and who shall serve a term of at least one year. On March 20, 2016, the independent directors appointed Mr. Jesselson to serve as lead independent director. The position of lead independent director has been structured to serve as an effective balance to the dual roles served by Mr. Jacobs. The lead independent director presides at all meetings of the Board of Directors at which the Chairman is not present and presides at all executive sessions of the independent directors. The Guidelines require that the independent directors meet at least once a year without members of management present, and the lead independent director is empowered to call additional meetings of the independent directors as necessary. In practice, in 2017, our independent directors met in executive sessions much more frequently. The lead independent director also serves as a liaison between the Chairman and the independent directors. Together with the Chairman, the lead independent director develops and approves Board meeting agendas, meeting schedules and meeting materials to be distributed to our Board of Directors in order to assure sufficient time for informed discussion of issues. The lead independent director is also available to meet with significant stockholders as appropriate and required.

Further information regarding the position of lead independent director is set forth in the Guidelines. The Guidelines are available on the company’s corporate website atwww.xpo.com under the Investors tab.

Our Board of Directors held seven meetings during 2017. In 2017, each person serving as a director attended at least 86% of the meetings of our Board of Directors and any Board committee on which he or she served. In addition, our Board of Directors also acted five times during 2017 via unanimous written consent.

Our directors are expected to attend the annual meeting. Any director who is unable to attend the annual meeting is expected to notify the Chairman of the Board in advance of the annual meeting. Each person who was then serving as a director attended the 2017

Our business and affairs are managed under the direction of our Board of Directors, which is our company's ultimate decision-making body, except with respect to those matters reserved to our stockholders. Our Board's primary responsibility is to seek to maximize long-term stockholder value. Our Board establishes our overall corporate policies, selects and evaluates our senior management team, which is charged with the conduct of our business, monitors the performance of our company and management, and provides advice and counsel to management. In fulfilling the Board's responsibilities, our directors have full access to our management, internal and external auditors and outside advisors.

Furthermore, our Board of Directors is committed to independent Board oversight. Our current Board leadership structure includes an executive chairman as well as a lead independent director and an independent vice chairman. The positions of chairman of the Board and chief executive officer are both currently held by Mr. Jacobs. Our Board believes that this combination of roles is appropriate because the structure enables decisive leadership and ensures clear accountability in the context of strong Board practices and a Board culture that facilitates independent oversight. Our Board believes the dual roles function well for our company based on our current strategy, governance and ownership structure.

To assist our Board to further strengthen its independent decision-making, our Board of Directors has approved a set of Corporate Governance Guidelines (the "Guidelines"), which provide that the independent directors may appoint a lead independent director who presides over executive sessions of the independent directors, and who shall serve a term of at least one year. On March 20, 2016, the independent directors appointed Mr. Jesselson to serve as lead independent director. The position of lead independent director has been structured to serve as an effective balance to the dual roles served by Mr. Jacobs. The lead independent director presides at all meetings of the Board of Directors at which the chairman is not present and presides at all executive sessions of the independent directors. The Guidelines require that the independent directors meet at least once a year without members of management present, and the lead independent director is empowered to call additional meetings of the independent directors as necessary. In practice, in 2018, our independent directors met in executive sessions much more frequently. The lead independent director also serves as a liaison between the chairman and the independent directors. Together with the chairman, the lead independent director develops and approves Board meeting agendas, meeting schedules and meeting materials to be distributed to our Board of Directors in order to assure sufficient time for informed discussion of issues. The lead independent director is also available to meet with significant stockholders as appropriate and required.

In addition, on February 7, 2019, the Board established an independent vice chairman position as part of its ongoing commitment to strong corporate governance. The position of vice chairman is defined as an independent director with authorities and duties that include, among others: (i) presiding at meetings of the Board where the chairman and lead independent director are not present; (ii) assisting the chairman, when appropriate, in carrying out his or her duties; (iii) assisting the lead independent director, when appropriate, in carrying out his or her duties; and (iv) such other duties, responsibilities and assistance as the Board or the chairman may determine. Ms. DeSalva was appointed to serve as vice chairman on February 7, 2019, to provide support on key governance matters and stockholder engagement to the chairman, lead independent director and the Board.

Further information regarding the positions of lead independent director and vice chairman is set forth in the Guidelines. The Guidelines are available on the company's corporate website atwww.xpo.com under the Investors tab.

Our Board of Directors held 14 meetings during 2018. In 2018, each person currently serving as a director attended at least 86% of the meetings of our Board of Directors and any Board committee on which he or she served. In addition, our Board of Directors acted twice during 2018 via unanimous written consent.

Our directors are expected to attend the annual meeting. Any director who is unable to attend the annual meeting is expected to notify the chairman of the Board in advance of the annual meeting. Marlene M. Colucci, who was appointed to the Board on February 7, 2019, has notified the chairman of the Board that she will be unable to attend the 2019 annual meeting due to a prior business commitment. Each of our then seven directors serving and standing for re-election attended the 2018 annual meeting of stockholders.

Our Board of Directors provides overall risk oversight with a focus on the most significant risks facing our company. Our business, strategy, operations, policies, controls and prospects are regularly discussed by our Board of Directors with our senior management team, including discussions as to current and potential risks and approaches for assessing, monitoring, mitigating and controlling risk exposure. The management of the risks that we face in the conduct of our business is primarily the responsibility of our senior management team. In addition, our Board of Directors has delegated responsibility for the oversight of specific risks to the committees of the Board as follows:

- ■

- Audit Committee.The Audit Committee oversees the policies that govern the process by which our exposure to risk is assessed and managed by management. In that role, the Audit Committee discusses with our management major financial risk exposures and the steps that management has taken to monitor and control these exposures. The Audit Committee

| | | | | | | | |

| | | | 18 | | | | ©2019 XPO Logistics, Inc. |

| | | | | | | | |

| | | | | | | | |

also is responsible for reviewing risks arising from related party transactions involving our company and for overseeing our company-wide Code of Business Ethics and overall compliance with legal and regulatory requirements.

- ■

- Compensation Committee.The Compensation Committee monitors the risks associated with our compensation philosophy and programs to ensure that the company has a compensation structure that strikes an appropriate balance in motivating our senior executives to deliver long-term results for the company's stockholders, while simultaneously holding our senior leadership team accountable.

- ■

- Nominating and Corporate Governance Committee.The Nominating and Corporate Governance Committee oversees risks related to our governance structure and processes.

- ■

- Acquisition Committee.The Acquisition Committee oversees risks related to the execution of our acquisition strategy.

In addition, our Board of Directors periodically holds special sessions to evaluate topical trends identified as significant risks or items of strategic interest, such as human resource management, information technology and cyber security. Our Board of Directors is committed to ensuring that our company has the focus, resources and infrastructure to appropriately address such risks.

In addition, our Board of Directors periodically holds special board sessions to discuss and analyze topical trends identified as significant risks or items of strategic interest, such as human capital management, information technology and cyber security. Our Board of Directors is committed to ensuring that our company has the focus, resources and infrastructure to appropriately address such risks.

Our Board of Directors has established four separately designated standing committees to assist the Board in discharging its responsibilities: the Audit Committee, the Compensation Committee, the Nominating and Corporate Governance Committee, and the Acquisition Committee. Our Board of Directors may eliminate or create additional committees as it deems appropriate. Each of our Board committees have written charters that comply with applicable SEC rules and the NYSE Listed Company Manual. These charters are available atwww.xpo.com. You may obtain a printed copy of any of these charters, without charge, by sending a request to: Secretary, XPO Logistics, Inc., Five American Lane, Greenwich, Connecticut 06831.

The Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee are composed entirely of independent directors within all applicable standards (as further discussed below). Our Board of Directors' general policy is to review and approve committee assignments annually. The Nominating and Corporate Governance Committee is responsible, after consultation with our chairman of the Board and consideration of appropriate member qualifications, to recommend to our Board of Directors all committee assignments, including designations of the chairmen. Each committee is authorized to retain, in each committee's sole authority, its own outside counsel and other advisors at the company's expense as it desires.

The following table sets forth the current membership of each of our Board committees as of the Record Date. Mr. Jacobs does not serve on any Board committees.

Name | | Audit Committee | | Compensation Committee | | Nominating and Corporate Governance Committee | | Acquisition Committee | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| | | | | | | | | | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| | | | | | | | ✓ | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Marlene M. Colucci

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Adrian P. Kingshott | | | | C | | | | ✓ | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Jason D. Papastavrou* | | ✓ | | ✓ | | ✓ | | C | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Oren G. Shaffer* | | C | | | | | | | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| | | | | | | | | | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

C =Committee chairman | | ✓

| | | * =Audit Committee | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A brief summary of the committees' responsibilities follows:

Audit Committee.Our Audit Committee has been established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), to assist our Board of Directors in fulfilling its responsibilities in a number of areas, including, without limitation, oversight of: (i) our accounting and financial reporting processes, including our systems of internal controls and disclosure controls, (ii) the integrity of our financial statements, (iii) our compliance with legal and regulatory requirements, (iv) the qualifications and independence of our independent registered public accounting firm, (v) the performance of our independent registered public accounting firm and internal audit function and (vi) related party transactions. Each member of the Audit Committee satisfies all applicable independence standards, has not participated in the preparation of our financial statements at any time during the past three years, and is able to read and understand fundamental financial statements. During 2018, the Audit Committee was comprised of the following three directors: Mr. Shaffer (chairman), Mr. Kingshott and Dr. Papastavrou. The Audit Committee met seven times during 2018 and, in addition, acted twice via unanimous written consent. Our Board of Directors has determined that Mr. Shaffer and Dr. Papastavrou each qualify

| | | | | | | | |

| | | | 19 | | | | ©2019 XPO Logistics, |

| | | | | | | | |

| | | | | | | | |

as an "audit committee financial expert" as defined under Item 407(d)(5) of Regulation S-K under the Exchange Act. On March 13, 2019, Mr. Kingshott stepped down as a member of the Audit Committee, and Ms. Ashe and Mr. Jesselson were appointed as members of the Audit Committee.

Compensation Committee.The primary responsibilities of the Compensation Committee are, among other things: (i) to oversee the administration of our compensation programs, (ii) to review and approve the compensation of our executive management, (iii) to review company contributions to qualified and non-qualified plans, and (iv) to prepare any report on executive compensation required by SEC rules and regulations. During 2018, the Compensation Committee was comprised of the following three directors: Mr. Kingshott (chairman), Mr. Jesselson and Dr. Papastavrou. The Compensation Committee met seven times during 2018 and, in addition, acted four times via unanimous written consent. On March 13, 2019, Ms. Colucci was appointed as a member of the Compensation Committee.

Nominating and Corporate Governance Committee.The primary responsibilities of the Nominating and Corporate Governance Committee are, among other things: (i) to identify individuals qualified to become Board members and recommend that our Board of Directors select such individuals to be presented for stockholder consideration at the annual meeting or to be appointed by the Board of Directors to fill a vacancy, (ii) to make recommendations to our Board of Directors concerning committee appointments, (iii) to develop, recommend to our Board of Directors and annually review the Guidelines and oversee corporate governance matters, and (iv) to oversee an annual evaluation of our Board of Directors and committees. From January 1, 2018 to May 17, 2018, the Nominating and Corporate Governance Committee was comprised of the following three directors: Ms. Ashe (chairman), Mr. Jesselson and Dr. Papastavrou. Ms. DeSalva replaced Ms. Ashe as the chairman on May 17, 2018. The Nominating and Corporate Governance Committee met four times during 2018.

Acquisition Committee.The Acquisition Committee is responsible for reviewing and approving acquisition, divestiture and related transactions proposed by our management in which the total consideration to be paid or received by us, for any particular transaction, does not exceed the limits that may be established by our Board of Directors from time to time. From January 1, 2018 to May 17, 2018, the Acquisition Committee was comprised of the following three directors: Dr. Papastavrou (chairman), Mr. Louis DeJoy and Mr. Kingshott. Ms. Ashe replaced Mr. DeJoy on May 17, 2018. The Acquisition Committee did not meet during 2018. On March 13, 2019, Ms. Colucci was appointed as a member of the Acquisition Committee.

The following table sets forth information concerning the compensation of each person who served as a non-employee director of our company during 2018.

|

| Name | | Fees Earned or Paid in Cash ($) | | Stock Awards(2) ($) | | Option Awards ($) | | Total ($) | | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | ||||||||||

Gena L. Ashe(3) | | | $ | 80,645 | | | | $ | 191,546 | | | | — | | | $ | 272,192 | | |

Louis DeJoy(4) | | | $ | 28,228 | | | | $ | 0 | | | | — | | | $ | 28,228 | | |

AnnaMaria DeSalva(5) | | | $ | 84,354 | | | | $ | 191,546 | | | | — | | | $ | 275,900 | | |

Michael G. Jesselson(6) | | | $ | 100,000 | | | | $ | 191,546 | | | | — | | | $ | 291,546 | | |

Adrian P. Kingshott(7) | | | $ | 90,000 | | | | $ | 191,546 | | | | — | | | $ | 281,546 | | |

Jason D. Papastavrou(8) | | | $ | 90,000 | | | | $ | 191,546 | | | | — | | | $ | 281,546 | | |

Oren G. Shaffer(9) | | | $ | 100,000 | | | | $ | 191,546 | | | | — | | | $ | 291,546 | | |

| | | | | | | | | | | ||||||||||

- (1)

- Compensation information for Mr. Jacobs, who is a NEO of our company, is disclosed in this Proxy Statement under the heading "Executive Compensation—Compensation Tables." Mr. Jacobs did not receive additional compensation for his service as a director.

- (2)

- The amounts reflected in this column represent the grant date fair value of the awards made in 2018, as computed in accordance with Financial Accounting Standards Board Accounting Standards Codification 718 "Compensation—Stock Compensation" ("ASC 718"). For further discussion of the assumptions used in the calculation of the grant date fair value, please see "Notes to Consolidated Financial Statements—Note 14. Stock-Based Compensation" of our company's Annual Report on Form 10-K for the year ended December 31, 2018. The values reported in this column represent 2,071 restricted stock units ("RSUs") granted to each of our directors on January 2, 2018. Each current director serving on January 2, 2019, also received a grant of 3,249 RSUs on such date for service as a director in 2019; these grants are not reflected in the table above.

- (3)

- As of December 31, 2018, Ms. Ashe held 8,757 RSUs. Does not include €65,000 of fees paid to Ms. Ashe for her service as vice-chairman of the Supervisory Board of XPO Logistics S.A., our majority-owned subsidiary.

- (4)

- Mr. DeJoy ceased to be a director of the company on May 17, 2018.

- (5)

- As of December 31, 2018, Ms. DeSalva held 2,071 RSUs. As of the Record Date, Ms. DeSalva beneficially owns a total of 2,881 shares of our common stock as disclosed in this proxy statement under the heading "Security Ownership of Certain Beneficial Owners and Management."

| | | | | | | | | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| | | | 20 | | | | ©2019 XPO Logistics, Inc. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| | | | | | | | | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||